How is your money financing climate change? Pension schemes and dodgy investments could be funding deforestation and other destructive environmental practices.

As consumers, we have a lot of buying power. We can decide to purchase items so long as we have money in the bank. However, it’s a lot more than that. Over the past few years, customers have become increasingly conscious of their funds. They want to support brands that not only have great products but that are also doing amazing things.

Whether it is that they are having a positive environmental or community impact, consumers are now eager to know their money is funding fair and sustainable practices.

We have partnered with climate action hero, Mindful Wealth, to simplify and spread awareness of the power of your money.

Continue reading to discover the link between how your money can affect climate change.

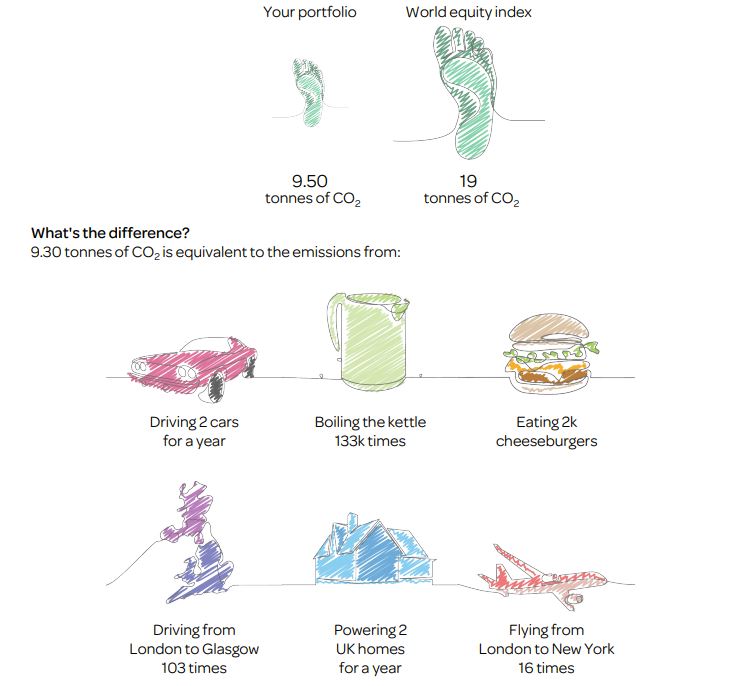

It may not be the most obvious way to reduce your carbon footprint but how you handle your personal finances greatly influences climate change. The link may not be as clear as things like the number of flights you take per year or how much waste you generate.

As a consumer with money to invest, your decisions can also help the planet. Unfortunately, many banks are well-known financiers of climate change. In their Banking on Climate Change report, the Rainforest Action Network (RAN) uncovered that since 2016, 35 banks had poured approximately $2.7 trillion into fossil fuels.

Fossil fuel finance is threatening the planet, and despite the logic here, many worldwide banks are still increasing funding for dirty energy. Chase was discovered to be the world’s worst banker of climate catastrophe so far. According to RAN, they contributed more than a quarter trillion dollars to fossil fuels over just four years.

Not only that, but the bank has also been a consistently poor actor in terms of violating human rights, particularly those of indigenous tribes. It is these communities that are helping us to protect the natural world and fight back against the fossil fuel industry. Chase is not the only bank supporting this industry and financing projects that negatively affect indigenous communities.

Another report from Make My Money Matter, SYSTEMIQ, and Global Canopy found that £300 billion of UK pension funds are invested in international financial institutions and businesses driving tropical deforestation. For the average pension saver in the UK, £2 of each £10 is invested in companies with high deforestation risk.

Unfortunately, pension funds have a significant influence over industries and sectors linked to conversion, deforestation, and associated human rights abuses. They do have the ability to help drive positive change not just within their own investments but also across the financial and private sector. In saying that, the lack of information for employers and pension holders makes it challenging to discover where pensions are being invested.

This lack of transparency means it is also very difficult to trace investments connected to deforestation. In addition to that, investors, banks, and pension funds have also contributed billions to the world’s biggest meat and dairy businesses over the last five years, according to a report. The report found that private financial backing for the world’s 35 biggest dairy and meat businesses equated to $478 billion.

A Euronews Green investigation uncovered that banks and investors headquartered in the EU, US, UK, and China made $1.74 billion in income from significant investments in agribusiness firms that are linked to deforestation in the five years after the Paris Agreement.

These banks include big names like JP Morgan, Deutsche Bank, Bank of China, and HSBC. The main reason it is happening is that the banks are able to profit well from the destruction of vital ecosystems. However, it is incredibly problematic as these forests act as essential carbon sinks that emit significant amounts of carbon when they are destroyed, adding to already problematic greenhouse gas emissions.

To put it into perspective, according to We Forum, if deforestation was a country, it would rank third in carbon emissions, following the US and China. Forests contain roughly 80 percent of the world’s terrestrial biodiversity and are home to indigenous tribes, so it is vital we protect them and mitigate climate risks.

Just as your finances and investments can be used to fund the climate crisis, there are also many ways you can ensure your finances address climate change more positively. Below are some ways you can be more mindful with your money.

Estimations show that there are around 1.6 million unclaimed pension pots out in the world right now. With an average worth of £13,000 each – over £19 billion in total. That means losing track of your pensions could already cost you…and the environment.

By simply tracking back your work history over the past 10 years may reveal pensions you never knew you had or had forgotten about. Find any paperwork you have been sent. If you do not have information, then your previous employer will do- its a legal requirement they keep these documents to hand.

Once you have the information, you can ask where your funds are invested. Often, the default funds are invested in heavily controversial industries such as tobacco and fossil fuels.

But, it doesn’t have to be this way! You can ask for alternatives that fund climate resilient development. A financial adviser will offer financial support if you need help.

Another way to be more mindful with your money is to make ethical climate investments. These kinds of investments are a big trend, and there can be excellent returns from them. Ethical investing involves the investor choosing investments based on their own ethics.

It aims to support industries that are having a positive impact, supporting mitigation and adaptation, and create an investment return. More ethical investments are taking place now than ever before, thanks to the increase in ESG (Environmental, social, and governance) funds. Some of these investments could include climate objectives like clean energy to drive the transition from fossil fuels.

You can also be more mindful with your money by making sustainable finance investments.

As well as avoid certain companies and industries, impact investments aim to invest in companies which create a net positive impact.

Impact investment managers look to have a positive impact through the assets and companies they choose to include in their social impact fund. Some examples of funds you could invest in include circular economy, sustainable energy, sustainable infrastructure, financial inclusion, education and employment, and much more.

It is also important to note here that you can create a green climate fund and greenify your workplace pension. You can do this by checking where your provider invests in. If you are not happy with what you find, you can ask your provider if they have any other funds you can switch to that are more ethical. They may have an ESG choice that is better than your default option. You have control over your workplace pension and what you would like to invest in. If you are unhappy with the options available, the Make My Money Matter campaign has some fantastic financial resources such as templates to help empower you to demand a greener finance alternative.

Your personal finances can be used to fund and contribute to global climate issues like deforestation. However, there are ways you can break the cycle and be more mindful with your money. We recommend following the advice of an ethical financial adviser like One Tribe climate action hero, Mindful Wealth. They believe finance can change the world for the better, and we at One Tribe second that.

Mindful Wealth ensures investors generate solid returns and profitable performance while resulting in real environmental and social benefits. It may not be the most obvious way to reduce your carbon footprint, but knowing how to manage your finances ethically can make a big difference. You can find out more about Mindful Wealth and its offering here.

climate finance, private sector, green climate fund, climate investment funds, paris agreement finance, climate change mitigation and adaptation, climate financing, climate policies surrounding finance, impacts of climate change from private finance, finance flows for climate change, reduce emissions with your finances, united nations climate finance, public and private finance, low carbon pensions, private investors, low greenhouse gas emissions, financially support developing countries, adaptation fund, world bank group, making finance flows consistent,

One Tribe is a Climate Action Platform enabling businesses and their customers to make a positive environmental impact.

Eric currently works as an independent consultant at the intersection of nature and climate, focused on catalysing market and non-market solutions to drive the just transition.

He previously was Head of Product at Earthshot Labs, supporting nature conservation and restoration projects across the global south secure project finance. Prior to Earthshot Labs, Eric led nature-based carbon project development for Gorongosa National Park in Mozambique and founded the Carbon Cooperative, a global alliance of leading nature conservation and restoration practitioners exploring carbon finance. After serving in the Peace Corps in Mozambique out of university, he spent much of his 20s working in community-based conservation and ecosystem restoration efforts in Sub-Saharan Africa interspersed with two startup ventures as co-founder and CEO of a mental health tech startup and COO of a sustainable coffee company. Eric has a dual Masters in Environmental Engineering and Environmental Policy from Stanford University where he was a NSF Graduate Research Fellow and a BS in Environmental Engineering from Tufts University.

Alan is a risk management thought-leader, superconnector, and FinTech pioneer. His mission is to enable an Earth Positive economy which includes nature in global accounting systems.

Alan is Founder of Generation Blue, a venture studio dedicated to planetary game changers powered by exponential technologies. Previously, Alan established Natural Capital Markets at Lykke AG, pioneering blockchain based forestry and carbon backed tokens. Alan has over two decades of risk management experience advising global financial institutions, and was a founding member of the RiskMetrics Group, a JPMorgan spin-off. Alan is an investor and advisor to regenerative impact ventures, including TreeBuddy.Earth, Regenativ, and Vlinder Climate.

Lori Whitecalf made history when she became the first woman to be elected Chief of Sweetgrass First Nation in 2011. She served three terms of office from 2011-2017.

Lori took a two-year hiatus from leadership to expand the family ranch and serve as the FSIN Senior Industry Liaison. She was re-elected on November 29. 2019 and again on November 30, 2021, as Chief of Sweetgrass. Chief Whitecalf practises a traditional lifestyle of hunting, fishing and gathering. She currently sits on the following boards: Saskatchewan Indian Institute of Technology, FSIN Lands and Resource Commission, Battle River Treaty 6 Health Centre and Battleford Agency Tribal Chiefs Executive Council, FSIN Women’s Commission.

Tina is the Chief Business Officer for MLTC Industrial Investments, the Economic Development arm of the Meadow Lake Tribal Council. She has a diverse background of experience. Having spent 15 years as a municipal Chief Operating Officer, 20 years involved in Saskatchewan’s Health Authority Board Keewatin Yatthe and 9 years with Northern Lights Board of Education.

She continues as a Board Member with Beaver River Community Futures supporting small business development in her home region. Tina brings a wealth of experience in a variety of fields and many connections to the Indigenous communities of Northern Saskatchewan. In addition Tina holds a BA Advanced from the U of S, a Certificate in Local Government Authority from the U of R and is certified as a Professional Economic Developer for Saskatchewan and a certified Technician Aboriginal Economic Developer (TAED).

Tootoosis’ career spans 40+ years in HRM, political leadership, and Indigenous economic development, as a dedicated bridge builder and advocate for Indigenous causes.

As a key member of the Saskatoon Regional Economic Development Authority (SREDA) team since 2021, he develops strategies for the Truth and Reconciliation Commission final report and Call to Action #92.

He is a graduate of the First Nations University of Canada and a certified Professional Aboriginal Economic Developer. Spearheading various community initiatives while serving as a Chair of the SIEDN while directing ILDII and WIBF. Founder of MGT Consulting Tootoosis is based in Saskatoon, Treaty Six Territory.

Cy Standing (Wakanya Najin in Dakota) has a long and distinguished career including serving overseas as an Electronics Technician in the Royal Canadian Air Force, former Chief of Wahpeton Dakota Nation, former Vice Chief of the Federation of Saskatchewan Indigenous Nations (FSIN), past Executive Director of Community Development Branch of the Department of Northern Saskatchewan as well as an Order in Council appointment to the Federal Parole Board.

Mr. Standing has served as a Director on many Profit and Non-Profit Corporate Boards, including serving as a Director for Affinity Credit Union with assets of over six billion dollars as well as IMI Brokerage and Wanuskewin and is currently a member of the One Tribe Indigenous Carbon Board.